Teach Kids About Money: Essentials of Financial Literacy

- Parents

- June 9, 2024

- Viva Education

Parents usually love to discuss culture, traditions, history, mythology, ethics, values and much more with their kids. Yet they often hesitate to broach the topic of money, as they think it might be too complex for their young ones. However, with the right approach, teaching financial literacy can be just as enjoyable and enriching for both parents and children alike!

Let’s think of it as planting seeds of financial wisdom that will grow with them. If we start early, we can empower our children to make informed decisions about money and set them on a path towards financial responsibility.

Financial literacy is primarily about developing a sound understanding of the issues related to finance. It is imperative for everyone, regardless of age. A financially literate individual can take charge of any situation in life, whether it’s managing their own domestic expenses, taking out a student loan, or making firm decisions about money management. To put it otherwise, financial literacy encompasses nearly all aspects of money management.

Role of Parents in Financial Education

As stated earlier, financial literacy is a critical life skill that enables people to make sound financial decisions. It is primarily the responsibility of the parents to develop this skill in their children by imparting valuable, age-appropriate financial insights to them. Teaching children about personal finances is one of the most important tasks cut out for us as parents and educators.

Fun and Engaging Ways to Teach Financial Literacy

1. Role Play

Our aim is to teach children about compounding and the mechanism of a bank. As you know, kids frequently have the urge to spend all of the money they receive. The parent can play the role of a bank, and the child may opt to store some money with them so as to earn interest (additional money) by not spending their pocket money. Kids can be rewarded for not spending money by receiving interest each month.

2. Providing Allowance

Giving kids an allowance for doing domestic chores is an excellent method to teach them about money management and budgeting. This will also help them learn the importance of taking responsibility.

3. Wish Day

Inculcating financial literacy may not be a cakewalk for the parents when they are bombarded with unending demands from children. What if there was a wish day to commemorate this? Yes, the day might occur every weekend or month, allowing the children to realise their aspirations. This will teach the children the value of patience and regulating their desires and wants without allowing them to take control.

4. Imaginary Market Scenario

Imagine a scenario where your child has access to a financial institution or money market with a lot of play money. Formulate it into a role play with close resemblance to real-life circumstances. Engage your kids and let them freely practise conducting transactions, counting money, and determining the value of goods and services. While making decisions, the children will get to learn important financial lessons.

Benefits of Financial Literacy for Kids

- Children, who have sound knowledge of finances understand the importance of money and how to manage it effectively. They understand that money won’t stay with them forever unless they make decisions judiciously about how to spend it.

- Financial literacy teaches children about the value of budgeting and saving. Children can learn how to allot stipulated budgets and save money, allowing them to efficiently manage their finances and ensure they have enough for the things they desire and need.

- Financial literacy also teaches children to make sound financial decisions. Children who are financially educated are better able to assess the risks and rewards of various financial goods and services and make informed decisions.

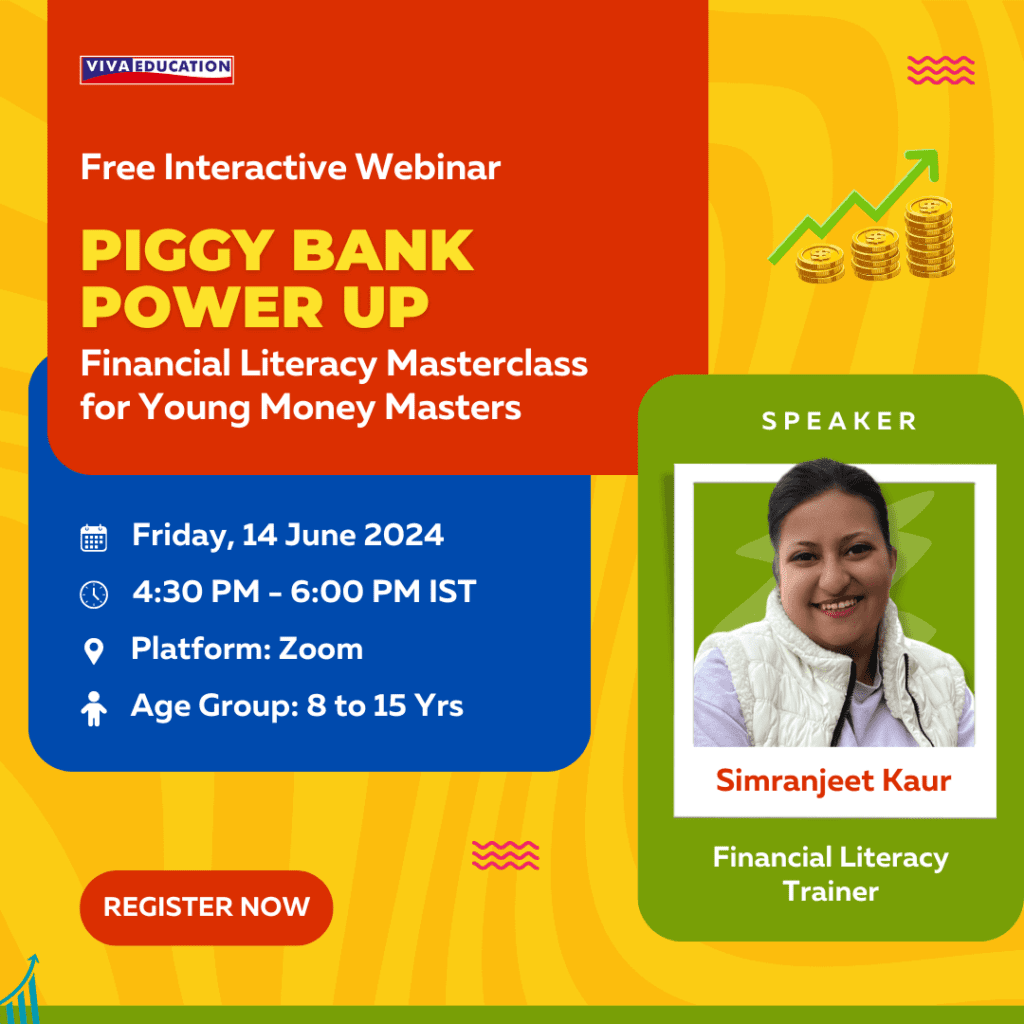

Workshop Announcement

It’s more important than ever to teach kids the basic money-related information and skills they need to get by in the real world. Viva Education is thrilled to announce that we are our Financial Literacy Workshop for Kids is raring to go for it!

This workshop is designed to empower your children with the tools they need to make informed decisions, build a secure future, and achieve their dreams by teaching them the basics of money management from an early age.

Why Join Our Workshop?

Here are some compelling reasons why this workshop is a great opportunity for your kids.

1. Building Fundamental Financial Skills

Our workshop will teach children the basics of saving, budgeting, and investing. They’ll learn the value of money, how to make smart spending choices, and how to avoid common financial pitfalls.

2. Evolving a Strong Financial Foundation

By learning to save and invest early, kids can establish habits that lead to financial security and resilience. This reduces the likelihood of future debt and financial stress.

3. Understanding the Banking System

It’s not just about money; it’s basically about understanding how banks operate, besides the purposes they serve, and how services like compounding can benefit them. Our motive is to introduce kids to banking services in a fun and engaging way.

4. Developing Responsible Financial Habits

Teaching kids to save and invest wisely from a young age blazes the trail for them to become responsible adults. It enables them to develop skills that will serve them well throughout their lives.

Join us and give your children the priceless gift of financial literacy. This workshop will help them grow into financially savvy adults who can navigate the world with confidence and security.

Read More: Nurturing Your Child’s Emotional Intelligence: Why EQ Might Matter More Than IQ